CBN strengthens regulations for BDCs and other foreign exchange participants

The agreement forbade holding BDCs in numerous names as well as fraudulently collecting foreign exchange from sources that were either eligible or prohibited.

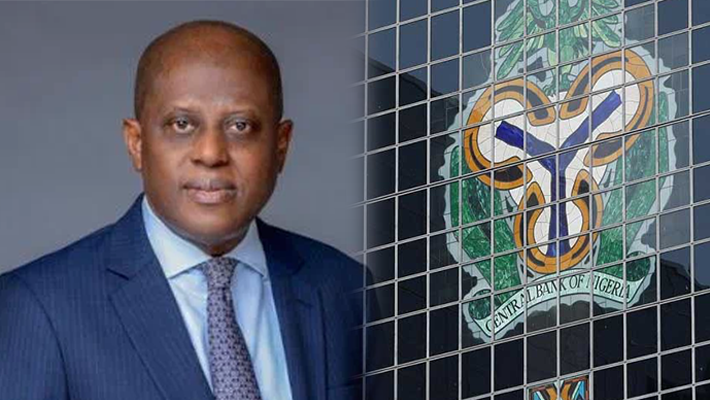

Yemi Cardoso, the governor of the Central Bank of Nigeria, is working to resolve foreign exchange problems.

A revised copy of the Regulatory and Supervisory Guidelines has been made available to all Bureau de Change (BDC) operators and other stakeholders in the finance industry by the Central Bank of Nigeria (CBN).

A notice of intent dated Friday, February 23, 2024, included the instructions that aim to improve the regulatory environment for BDC activities as part of the continuing reforms of the Nigerian foreign currency market.

The 50-page recommendations were appended to a notice certified by Haruna Mustafa, Director, Financial Policy and Regulation Department, CBN.

The guidelines outlined the permitted activities, license procedures, company governance, and BDC-specific protection against money laundering and counterterrorism financing regulations.

The CBN website published the draft paper, which included additional standards for corporate governance, financial needs, and record-keeping and reporting.

Following the authority granted by Section 56 of the Banks and Other Financial Institutions Act, 2020 (BOFIA), the Central Bank of Nigeria (CBN) is soliciting feedback and/or comments from stakeholders regarding the draft revised Regulatory and Supervisory Guidelines for Bureau de Change (BDC) Operations in Nigeria.

The Guidelines constitute an important improvement to the Bureau De Change’s system of regulation as part of the continuous improvements to the Nigerian foreign currency system.

The Standards update BDCs’ ability to engage in certain operations, license requirements, corporate governance, and Anti-Money Laundering/Combating the Financing of Terrorism (AML/CFT) laws.

The notice stated, among other things, that it “also sets out new record-keeping and reporting requirements.”

According to Mustafa, the draft guidelines may be found at www.cbn.gov.ng, the website of the CBN.

By March 4, 2024, he asked interested parties to send soft copies of their views to PolicyandRegulationDivision@cbn.gov.ng, the Director of the Financial Policy and Regulation Department at the CBN in Abuja.

Some sections of the 50-page draft paper, according to the News Agency of Nigeria (NAN), focused on eradicating corruption, promoting accountability, and stockpiling of forex.

It provided requirements for the BDC operating license to be revoked as well as justifications for keeping records on file.

Draft item 18.0 of the schedule states, “Every BDC shall maintain documents obtained from its customers for at least five years after the consummation of the transaction.”

It stated that in the event that a BDC’s operator or any of its affiliates forges, mutilates, changes, or defaces any foreign currency or other FX instruments with the aim to defraud, the CBN may cancel the BDC’s license.

The agreement forbade holding BDCs in numerous names as well as fraudulently collecting foreign exchange from sources that were either eligible or ineligible.

Sanctions for further regulatory violations were also outlined.