After three consecutive pauses, the Central Bank of Nigeria’s (CBN) Monetary Policy Committee lowered the benchmark interest rate to 27.0 percent, the first drop in 2025 and an indication of a policy change in favour of economic recovery.

Although they applauded the action, members of the Organised Private Sector contended that the cut was insufficient to alleviate the credit crunch on small firms and manufacturers.

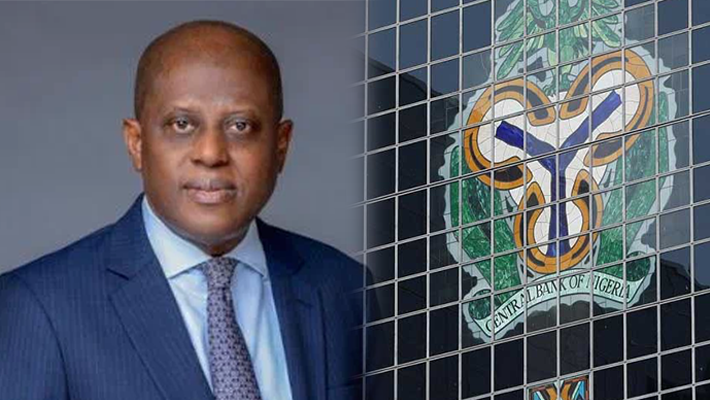

Following the committee’s 302nd meeting, CBN Governor Olayemi Cardoso announced the decision at a press event in Abuja on Tuesday. He added that all 12 members voted in favour of a 50 basis point drop from 27.5%.

The committee also implemented a 75 percent CRR on non-TSA public sector deposits, increased the need for commercial banks to 45 percent while keeping merchant banks at 16 percent, and modified the Standing Facilities corridor to +250/-250 basis points. At 30%, the liquidity ratio remained constant.

According to Cardoso, “sustained disinflation recorded in the past five months, projections of declining inflation for the rest of 2025, and the need to support economic recovery efforts” served as the foundation for the decision.

According to the MPC, headline inflation decreased from 21.88 percent in July to 20.12 percent in August. While core inflation decreased to 20.33 percent from 21.33 percent, food inflation decreased to 21.87 percent from 22.74 percent. Inflation decreased significantly month-over-month from 1.99 percent in July to 0.74 percent in August.

Cardoso stated, “This reduction is the first in five years and the first under my leadership.” The policy rate was last lowered by Nigeria in September 2020, when it fell from 12.5% to 11.5%.

A similar pattern is emerging throughout Africa. Kenya lowered its benchmark rate to 9.5% in August, while Ghana cut its policy rate by 350 basis points to 21.5% only last week. Nigeria still has one of the highest rates on the continent despite its decrease.

Positive macroeconomic developments were also emphasised by the MPC, especially Nigeria’s GDP growth in the second quarter, which increased to 4.23 percent from 3.13 percent in the first.

The oil industry, which grew by 20.46 percent as opposed to just 1.87 percent in the prior quarter, was a major contributor to the recovery.

Noting that continued production increase will bolster foreign reserves and stabilise the naira, the committee praised the Federal Government for enhancing security in oil-producing zones.

With an 8.28-month import cover, foreign reserves increased from $40.51 billion at the end of July to $43.05 billion as of September 11, 2025. Additionally, the current account balance increased from $2.85 billion in Q1 to $5.28 billion in Q2.

Cardoso revealed that 14 banks have already complied with the new recapitalisation regulations, indicating that the industry is still robust and that financial soundness metrics are within prudential bounds.

With the help of the harvest season, falling petrol prices and exchange rate stability, the MPC forecasted further disinflation in the future. November 24–25, 2025 is the date of the upcoming MPC meeting.

Members of the Organised Private Sector contended that although the rate cut was generally regarded as a positive move, it was still insignificant and would not alleviate the credit crunch on small firms and manufacturers.

Segun Ajayi-Kadir, director-general of the Manufacturers Association of Nigeria (MAN), said the cut was welcome but insufficient. “We predict a decrease in rates almost every time the MPC meets. While this is good, it hasn’t met our expectations in the slightest. For their borrowing to boost output, manufacturers must borrow no more than 5%, he stated.

Ajayi-Kadir underlined that borrowing prices are still unsustainable because no bank would lend at a rate lower than the MPR. “It shows that the CBN is reconsidering, but manufacturers are still waiting for a period when rates will be much lower,” he continued.

Adewale Oyerinde, the Director-General of the Nigeria Employers’ Consultative Association (NECA), also cautioned that other restrictive measures, such the high CRR, could lessen the impact of the cut. “Businesses can expand investments, create jobs, and obtain affordable financing if credit costs are reduced.” However, these results could be limited by the consistently high CRR and liquidity constraints, according to Oyerinde.

He said that although August saw a slowdown in inflation, food inflation, which stands at 21.87 percent, is still reducing disposable earnings. He went on to say, “Macroeconomic stability must translate into tangible relief for Nigerians,” and he urged the government to implement structural changes in addition to monetary policy.

The rate drop was described as a “good start” but “insignificant” un the larger context by Dr. Femi Egbesola, president of the Association of Small Business Owners of Nigeria. Our nation continues to rank among the best when compared to other developing nations. For SMEs, obtaining financing continues to be the biggest obstacle. In comparison to the strain on the real sector, a 0.5 drop is negligible,” he stated.

Egbesola urged small firms to have access to special lending windows with single-digit interest rates, emphasising the need to look into funding options outside of banks.

Similar opinions were expressed by the Centre for the Promotion of Private Enterprise, which praised the MPC’s action but emphasised the necessity of additional fiscal measures.

Dr. Muda Yusuf, its director, called the rate decrease “a welcome and timely intervention,” adding that banks should be able to create credit and slash lending rates as a result of the lower MPR and lower CRR. This will help companies grow, boost output, and provide employment,” Yusuf stated.

But he emphasised that monetary easing is insufficient on its own. “To ensure macroeconomic stability and investor confidence, fiscal authorities must prioritise infrastructure to lower production costs, strengthen the regulatory framework, and maintain fiscal consolidation,” he stated.

Yusuf also called on the government to address the issue of insecurity, which still poses a danger to rural production and private investment.

The CBN’s decision, according to observers, represents a dramatic change in monetary policy from stabilisation to growth acceleration. Although inflation is still high, analysts point out that the trend towards disinflation allows for cautious easing to aid in the recovery.

Although the cut does not provide immediate assistance, it is a message of purpose for employers, manufacturers, and small companies. The OPS as a whole agrees that in order to fully realise the potential of Nigeria’s productive sectors, loan costs need to decrease much more, ideally to single digits.

In summary, Yusuf stated that “the new stance could stimulate growth, improve private sector performance, boost revenues, and moderate inflation sustainably in the medium to long term if sustained and backed by fiscal and structural reforms.”

Although it warned that borrowing costs are still too high for firms, the Nigeria Labour Congress hailed the CBN’s decision to lower the Monetary Policy Rate from 27.50 percent to 27 percent as a positive move.

Onyekachi Christopher, the NLC’s assistant secretary-general, said that although it is positive that authorities are thinking about lowering rates, the current level of 27% is still extremely high.

As a group that supports workers’ rights, Onyekachi stated, “We want to see manufacturers get better access to financing, produce more goods, hire more people, and make more significant contributions to the economy.” “These objectives would be supported by easier access to bank loans, which would benefit workers and businesses in the long run.”

Interest rate theory is still important in Nigeria, according to Sheriffdeen Tella, a professor of economics and former vice-chancellor of Crescent University in Abeokuta.

The CBN probably believed that since inflation was declining, it might lower interest rates. High interest rates make borrowing more expensive, which raises a company’s manufacturing expenses. Since profits rarely surpass 20–30% per year, borrowing is unappealing at current levels and loans are difficult to defend. Rates are still quite high, despite the decrease being a good beginning, he stated.

According to Marcel Okeke, a former chief economist at Zenith Bank, the rate drop marks the start of a relaxation of the CBN’s strict monetary policy. For the most part, the Monetary Policy Rate is suggestive. It tells commercial banks that instead of maintaining high lending rates all the time, they can start to lower them. In essence, it indicates that the CBN is starting to relax its strict monetary policy,” he said.

According to Okeke, the CBN’s strict stance has historically caused high lending rates by pushing the MPR to about 27.5%. The first step in changing that trend is this reduction. Bank rate reductions, even if they are merely 1-2 percent, are symbolic but significant. If inflation keeps falling, more cuts might be made at the CBN’s next meeting in November, the analyst continued.

He emphasised that the rate of inflation has decreased from about 35% in December 2024 to roughly 20.13% in August 2025. The CBN is probably going to lower the NPR even more if it keeps down to about 17–18%.

“Loans become more affordable with lower interest rates, expanding credit availability and boosting the economy.” However, there is a delay between the execution of the policy and its apparent impact, thus the effect is not instantaneous. Inflation trends and currency rate stability will also determine future reductions, Okeke stated.