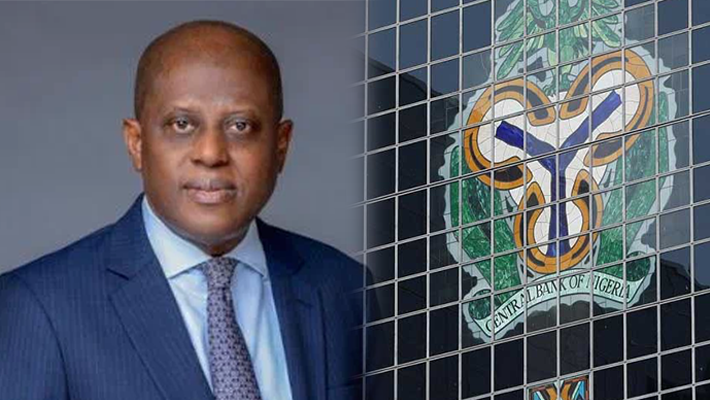

As inflation continues to decrease, Mr. Olayemi Cardoso, the governor of the Central Bank of Nigeria (CBN), has signaled that lending rates may drop in the upcoming months, boosting optimism for better credit availability and more robust investment flows.

During a fireside talk at the European Business Chamber’s (Eurocham Nigeria) C-Level Forum in Lagos on Saturday, Cardoso provided the assurance.

The CBN reiterated its commitment to macroeconomic stability, a more robust banking industry, and establishing Nigeria as a premier investment destination in a statement released on Sunday.

The CBN governor claims that although headline inflation is still high, it has started to decline, which could lead to reduced lending rates if price stability is further solidified.

“As inflation continues to decline and as markets become more efficient in allocating capital, there is a substantial potential for interest rates to decrease in the future,” the statement said.

“That is the environment in which stronger corporate lending and higher levels of investment will naturally follow,” he was also cited as saying in the release.

While acknowledging that businesses have been negatively impacted by high lending rates, Cardoso clarified that the CBN’s top aim has been to rebuild trust and increase the system’s resilience.

“We will protect the stability that has been re-established in the financial system with the utmost zeal,” the statement quoted him as saying. “Our primary objective is to maintain that stability while simultaneously addressing inflation and ensuring that the financial system is sufficiently resilient to facilitate corporate lending and investment.”

The Governor highlighted the progress of the ongoing bank recapitalisation exercise, which he described as critical for safeguarding the financial system.

He explained that the new minimum capital requirements would produce stronger institutions capable of withstanding shocks and financing broader economic growth.

He further stressed that technology-driven solutions and the deepening of financial inclusion were key priorities for the Bank.

According to him, expanding access to fintech platforms and supporting innovation will play a central role in tackling poverty and bridging financing gaps.

In order to combat poverty and close the financial gap, he believes that increasing access to fintech platforms and encouraging innovation will be crucial.

A positive change in Nigeria’s policy environment, Cardoso also highlighted increased coordination with the fiscal authorities, pointing out that cooperation with the Budget Office, the Ministry of Trade and Industry, and the Ministry of Finance “will enable the country to sustain reforms and achieve long-term stability.”

Speaking about Nigeria’s place in the world economy, the governor of the Central Bank of Nigeria said that the nation has a special role to play in West Africa and beyond because of its size and strategic location.

Later, Eurocham President Yann Gilbert hailed the forum as a crucial forum for communication between European businesses and Nigerian policymakers, noting that members of the chamber were dedicated to long-term partnerships in Nigeria, with a focus on job creation and sustainable investment.

“The urgency of addressing our own affairs is underscored by the ongoing geopolitical changes,” he noted, adding that Nigeria is a market that is both large and appealing in its own right, as well as situated at the entrance to the broader continent and West Africa.

The Monetary Policy Rate increased from 18.75 percent at the beginning of 2024 to 27.50 percent by the end of the year as a result of the CBN’s six increases in its benchmark lending rate.

The goal of the vigorous tightening cycle was to stabilize the naira after it had been under constant pressure and stop unchecked inflation.

According to records, the rises implemented during all six of the 2024 MPC meetings constituted the most severe monetary tightening in recent memory.

Statements reaffirming the Bank’s determination to restore price stability and bolster investor confidence in the domestic economy were issued after each decision.

The MPR reached its highest level ever, 27.50 percent, following the last rise that was announced at the November meeting.

However, the tightening cycle has paused as of 2025. In all of its meetings this year, including those in February, May, and July, the CBN has maintained the rate at 27.50 percent.

In June 2025, businesses in Nigeria named high interest rates as the worst obstacle to their operations, surpassing long-standing issues like insecurity and inadequate electricity supply, according to a previous story .

This information was revealed by the CBN in its June 2025 Business Expectations Survey, which surveyed 1,900 businesses in the industrial, services, and agricultural sectors.

The report states that the constraint index gave high interest rates a score of 75.6, followed by insecurity at 75.2 and a lack of power supply at 74.3.

Dr. Chinyere Almona, the Director-General of the Lagos Chamber of Commerce and Industry, had previously cautioned that keeping the MPR at 27.5% would put a heavy burden on companies.

We must reiterate that businesses continue to face a depressing burden due to the interest rate of 27.5%. As a result, we would like to see the Monetary Policy Rate lowered,” Almona stated.

The Bank’s public calendar indicates that the next meeting of the Monetary Policy Committee will take place on September 22 and 23, 2025.

As inflation continues to decline, market observers are waiting for clues from that meeting about whether the regulator will continue to stop or start to loosen policy.