The Central Bank of Nigeria (CBN) and its Monetary Policy Committee (MPC) have implemented strategic measures to stabilize the naira and control inflation, marking a significant shift in the nation’s macroeconomic direction. At the 299th MPC meeting, held on February 19 and 20, 2025, the committee decided to maintain the Monetary Policy Rate (MPR) at 27.5 percent, demonstrating a commitment to balancing inflation control with exchange rate stability. CBN Governor Olayemi Cardoso announced this decision, emphasizing the unanimous agreement to retain all parameters, including the asymmetric corridor, cash reserve ratio,…

Tag: CBN

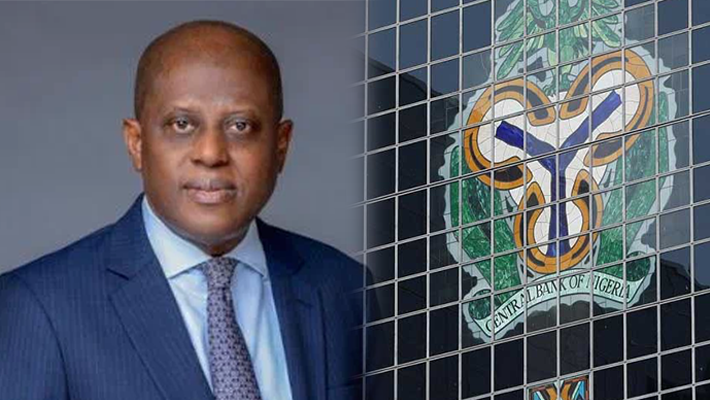

BREAKING: CBN retains interest rate at 27.50%, maintains other parameters

The Central Bank of Nigeria (CBN) Monetary Policy Committee (MPC) has unanimously decided to hold all the parameters. This was announced by the CBN Governor, Mr Olayemi Cardoso, on Thursday during a press briefing in Abuja. In this regard, that keeps the Monetary Policy Rate (MPR) at 27.50 percent, and retains the asymmetric corridor around the MPR at +500/-100 basis points. The MPC also retained the Cash Reserve Ratio of Deposit Money Banks at 50.00 per cent, Merchant Banks at 16 percent, and Liquidity Ratio at 30.00 percent.

CBN Demands Transparency: Banks to Publish Unclaimed Balances

The Central Bank of Nigeria (CBN) has directed all banks and financial institutions to publicly disclose details of dormant accounts, unclaimed balances, and other financial assets on their official websites. The directive, contained in a circular issued on Monday, is titled “Guidelines on Management of Dormant Accounts, Unclaimed Balances, and Other Financial Assets in Banks and Other Financial Institutions in Nigeria.” The circular was signed by Michael Akuka on behalf of the Director of CBN’s Financial Policy and Regulation Department. As part of the new regulations, financial institutions are required…

ECOWAS court dismisses suits on Kudirat Abiola’s assassination

The Community Court of Justice, ECOWAS, has dismissed a case filed against the Federal Government of Nigeria on the assassination of the late Mrs. Kudirat Abiola, the wife of the winner of June 12, 1993 presidential election, M.K.O Abiola. The suit was filed by three members of the Abiola’s family, Khalifa Abiola, Moriam Abiola and Hadi Abiola, who alleged Kudirat’s rights violations with her was assassinated in 1996 while advocating her husband’s release from detention. According to the applicants, the Nigerian government violated Kudirat’s fundamental human rights by failing to…

Federal Government Announces Imminent Resumption of ALSCON Production

The Federal Government has announced that the Aluminum Smelter Company of Nigeria (ALSCON) in Ikot Abasi, Akwa Ibom State, is poised to resume production soon. This announcement came after a visit to the plant by the Minister of Steel Development, Prince Shuaibu Abubakar Audu. The Minister expressed satisfaction with the condition of the equipment and facilities, despite the plant’s decade-long shutdown, signaling a renewed commitment to revitalizing this key industrial asset. Minister Audu outlined several key steps being taken to facilitate ALSCON’s reopening. He emphasized that ongoing consultations and stakeholder…

CBN Clears $7bn FX Backlog, Boosting Market Confidence

Central Bank of Nigeria Governor, Olayemi Cardoso, announced Wednesday that the government has resolved the long-standing $7 billion foreign exchange backlog. Following a forensic audit, verified claims have been settled, paving the way for businesses, multinational corporations, and foreign investors to repatriate funds without hindrance. Cardoso made the announcement at the launch of Nigeria’s Regulatory Policy Framework, hosted by the Presidential Enabling Business Environment Council (PEBEC) in Abuja. He acknowledged the delays in resolving the backlog, attributing them to past irregularities, and emphasized the government’s commitment to strengthening the market…

The SEC creates rules for providers of digital assets in order to prevent money laundering

The SEC creates rules for providers of digital assets in order to prevent money laundering Amid the FG’s recent efforts to stop illicit cryptocurrency trading in the nation, new regulations to further regulate cryptocurrency trading have been introduced. New regulations have been released by the Securities and Exchange Commission (SEC) to oversee the licensing, registration, and background checks of virtual asset service providers (VASPs). VASPs are platforms that manage virtual asset transfers and facilitate exchanges between virtual assets (cryptocurrencies) and fiat currency, according to the Central Bank of Nigeria (CBN).…

CBN strengthens regulations for BDCs and other foreign exchange participants

CBN strengthens regulations for BDCs and other foreign exchange participants The agreement forbade holding BDCs in numerous names as well as fraudulently collecting foreign exchange from sources that were either eligible or prohibited. Yemi Cardoso, the governor of the Central Bank of Nigeria, is working to resolve foreign exchange problems. A revised copy of the Regulatory and Supervisory Guidelines has been made available to all Bureau de Change (BDC) operators and other stakeholders in the finance industry by the Central Bank of Nigeria (CBN). A notice of intent dated Friday,…

CBN Orders FX Sellers With $10,000 And Above To Declare Sources

CBN Orders FX Sellers With $10,000 And Above To Declare Sources The Central Bank of Nigeria (CBN) has announced that individuals selling foreign exchange to Bureau De Change (BDC) in amounts equivalent to 10,000 dollars or more must disclose the sources of their forex. This directive is part of a revised regulatory framework aimed at controlling the activities of BDCs and reducing instability in the foreign exchange market. Sellers are also required to adhere to Anti-Money Laundering/Combating the Financing of Terrorism (AML/CFT) regulations, as well as foreign exchange laws and…

Become “Verve Aware” to make easy online payments

Become “Verve Aware” to make easy online payments Enter a world of sweetness and ease with Verve, the revolutionary digital payment solution! It’s time to use your Verve Card to live the good life and add a little enchantment to your transactions! Envision a society in which completing payments online is not only simple but fashionable as well! Imagine yourself using Verve to effortlessly swipe to binge-watch your favorite Netflix and Prime Video episodes, dance to the music on Spotify, pay for subscriptions on Google Play, or even run advertising…